Disclaimer: Investing involves risk. There’s no guarantee of profit, and it’s possible to lose your initial investment. This article provides general information and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

The Power of Compounding Interest

One of the most powerful tools for building wealth is compound interest. This is the interest earned on both your initial investment and the accumulated interest over time. Even a small amount can grow exponentially when compounded over decades.

Example:

- Initial investment: $100

- Annual return: 7%

- Time period: 50 years

- Final amount: $3,045,635.41

As you can see, a modest initial investment can turn into a substantial sum over time, thanks to the magic of compounding.

10 Steps to Invest $100 and Make a Million

- Start Early: The earlier you start investing, the more time your money has to grow. Even if you can only invest a small amount, it will make a significant difference in the long run. 1. github.com MIT github.comAdvertisement

- Choose a Low-Cost Index Fund: Index funds track a market index, like the S&P 500. They typically have lower expense ratios than actively managed funds, which can significantly impact your returns over time.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, regardless of the market’s current price. This helps to smooth out the impact of market fluctuations.

- Invest Consistently: Make investing a habit. Set aside a portion of your income each month and contribute it to your investment account.

- Avoid Market Timing: Trying to predict the market’s ups and downs is difficult and often leads to poor investment decisions. Instead, focus on long-term investing and stay the course, even during market downturns.

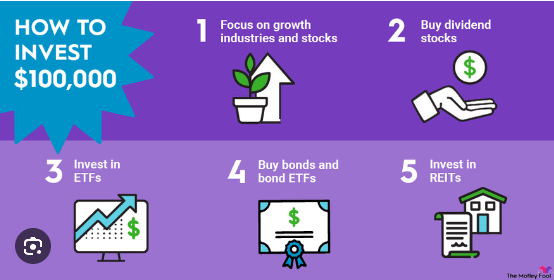

- Diversify Your Investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce your risk. 1. legitincomeplug.com legitincomeplug.com 2. mumsmoneycorner.com mumsmoneycorner.com

- Rebalance Your Portfolio Regularly: As your investments grow and market conditions change, it’s important to rebalance your portfolio to ensure that it aligns with your risk tolerance and investment goals.

- Avoid High-Fee Investments: Be wary of investments with high fees, such as mutual funds with high expense ratios or annuities. These fees can significantly erode your returns over time.

- Consider Tax-Advantaged Accounts: Explore tax-advantaged accounts like IRAs and 401(k)s to reduce your tax burden and grow your wealth more efficiently.

- Stay Informed: Keep up-to-date on economic news, market trends, and investment strategies. This will help you make informed decisions and stay on track toward your financial goals.

Additional Tips

- Set Realistic Goals: Determine how much money you want to accumulate and how long you’re willing to invest.

- Be Patient: Building wealth takes time. Don’t get discouraged if you don’t see immediate results.

- Seek Professional Advice: If you’re unsure about investing, consider consulting with a financial advisor. They can help you create a personalized investment plan and provide guidance along the way.

- Live Below Your Means: To maximize your savings and investment potential, it’s important to live below your means and avoid unnecessary expenses.

Remember, the key to investing $100 and making a million is to start early, invest consistently, and let compound interest do its work. With patience, discipline, and a long-term perspective, you can achieve your financial goals.